This is one bridge I am HAPPY to cross today!!!

In today’s housing market, where supply is very low and demand is very high, home values are increasing rapidly. Many experts are projecting that home values could appreciate by another 4% or more over the next twelve months. One major challenge in such a market is the bank appraisal.

When prices are surging, it is difficult for appraisers to find adequate, comparable sales (similar houses in the neighborhood that recently closed) to defend the selling price when performing the appraisal for the bank.

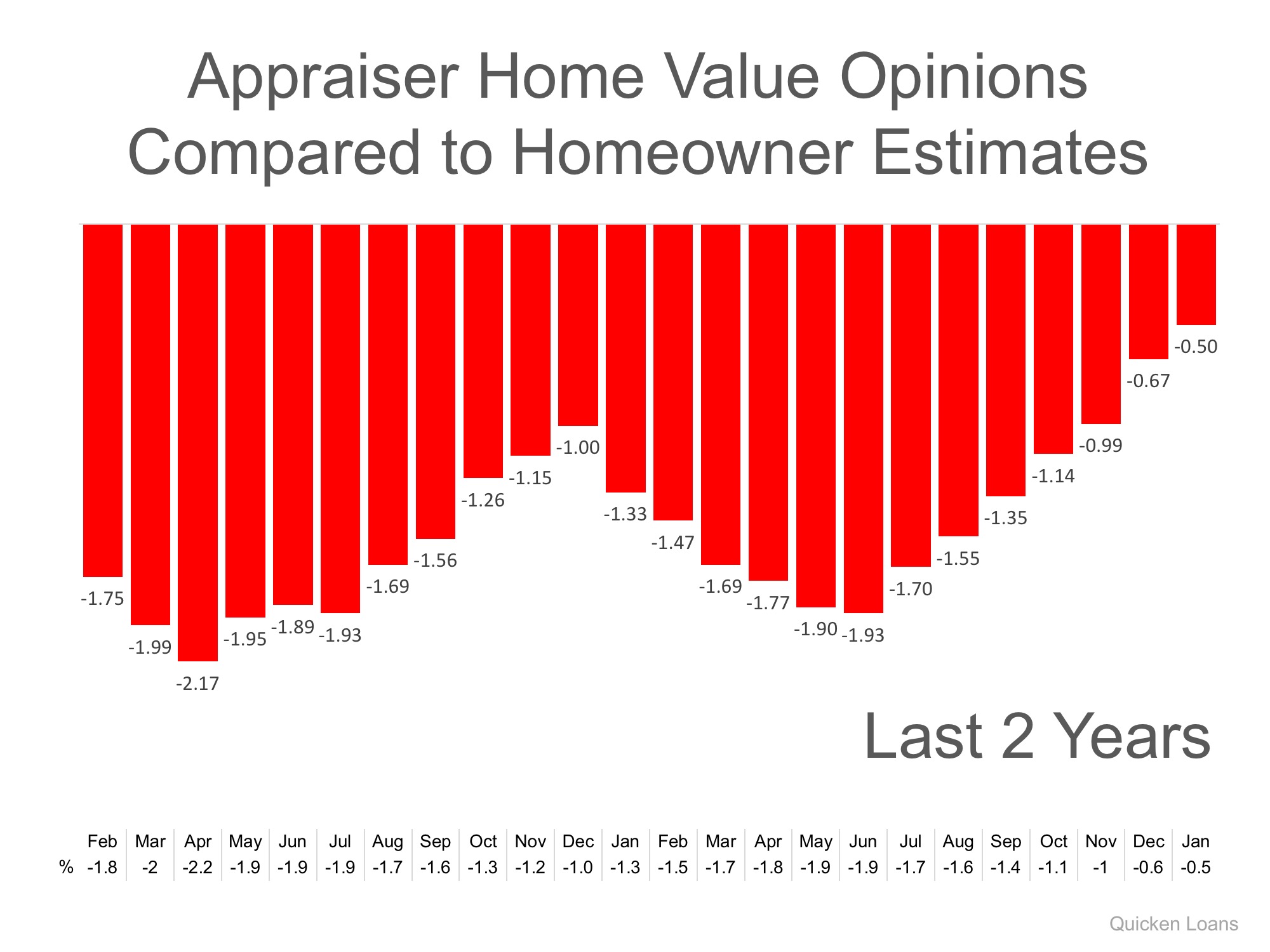

Every month in their Home Price Perception Index (HPPI), Quicken Loans measures the disparity between what a homeowner who is seeking to refinance their home believes their house is worth and what an appraiser’s evaluation of that same home is.

In the latest release, the disparity was the narrowest it has been in over two years, as the gap between appraisers and homeowners was only -0.5%. This is important for homeowners to note as even a .5% difference in appraisal can mean thousands of dollars that a buyer or seller would have to come up with at closing (depending on the price of the home)

The chart below illustrates the changes in home price estimates over the last two years.

Bill Banfield, Executive VP of Capital Markets at Quicken Loans urges homeowners to find out how their local markets have been impacted by supply and demand:

“Appraisers and real estate professionals evaluate their local housing markets daily. Homeowners, on the other hand, may only think about their housing market when they see ‘for sale’ signs hit front yards in the spring or when they think about accessing their equity.”

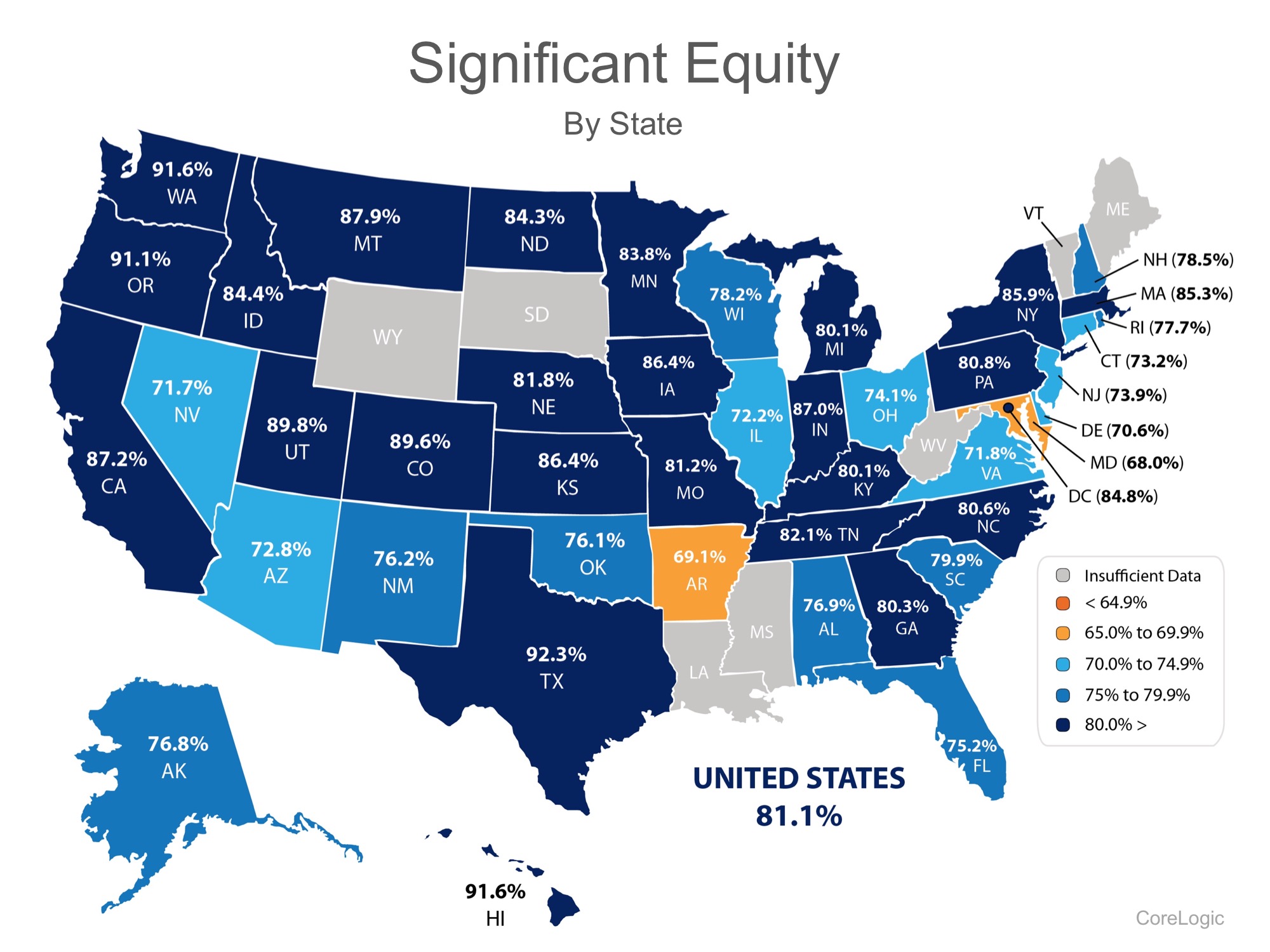

“With several years of growth, owners may have more equity than they realize. Many consumers use the tax season at the beginning of the year to reevaluate their entire financial life. It also provides a good opportunity for them to consider how best to take advantage of their equity while mortgage interest rates and borrowing costs are still near record lows.”

Bottom Line

Every house on the market must be sold twice; once to a prospective buyer and then to the bank (through the bank’s appraisal). With escalating prices, the second sale might be even more difficult than the first. If you are planning on entering the housing market this year, let’s get together to discuss this and any other obstacles that may arise.

Hooray! That means when I give you a Market Analysis on your home the bank appraisers for your prospective buyers will be more apt to agree with the contracted sale price!

As we get more inventory and, in effect more sales, the market more clearly reflects current home values. This has been a challenge as supply and demand makes a huge difference in local market price that is not proportionally reflected by the independent appraisers reports.

So today we celebrate! Now let’s get your home on this amazing market!

Get educated – Let’s talk! 413.301.4614

Visit me at: ToriDentonRealtor

Helping you make the right MOVE – one HOME at a time!!

Chris & Lisa Burke on the purchase of your first home today in Westfield!

Chris & Lisa Burke on the purchase of your first home today in Westfield!

Comments